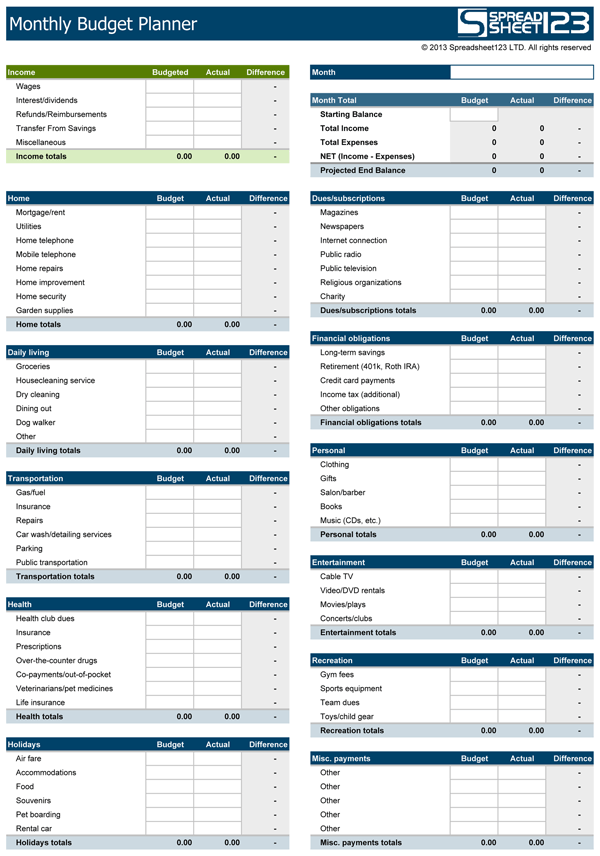

It’s best to assign your dollars to categories based on due date and/or urgency.Īsk yourself how much money you have and what it needs to do before your next paycheck. That’s how much money you have to distribute to each of these categories right now. Step Two: How Much Do You Have? “How much money do I have and what does it need to do before my next paycheck?” But you’re missing out on the best and most effective way of managing your personal finances if you stop there! Keep going because this is where it gets good. Now, before we get to step two, I want to call out that perhaps when you’ve previously thought of “budgeting” or “making a budget” that you’re done after step one. Your budget (and your spending habits) should be a reflection of what matters to you.

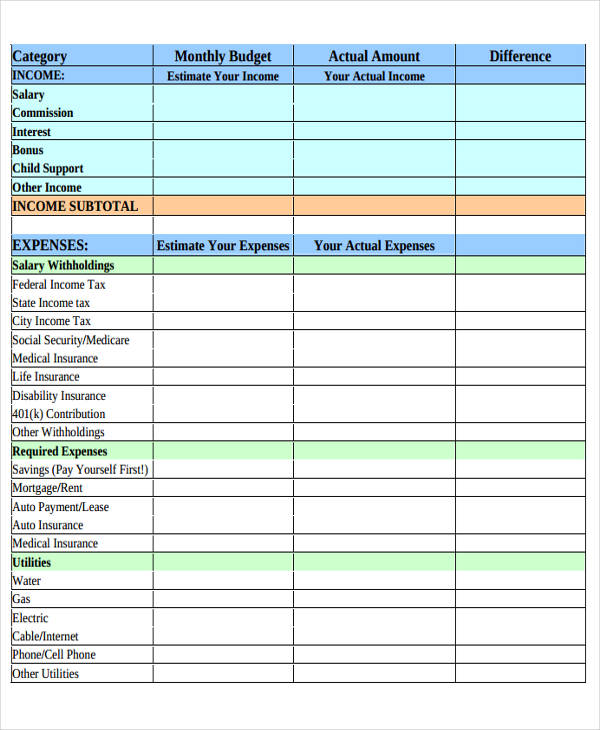

You’ll have a little more wiggle room when it comes to fun expenses and savings goals, but use those numbers to create a little accountability in your life-is your priority bottomless mimosas at brunch every Sunday or a three month emergency fund? There’s no wrong answer (regardless of what your dad would think). For non-monthly or variable expenses, like Christmas gifts, auto registration, car insurance, or annual subscriptions, divide your estimate by the number of months it takes for that cost to recur so that you can contribute manageable chunks on a monthly basis instead of choking on the whole cost when it comes up. Monthly expenses like rent, cell phone bill, electricity, student loan payments, health insurance, etc.

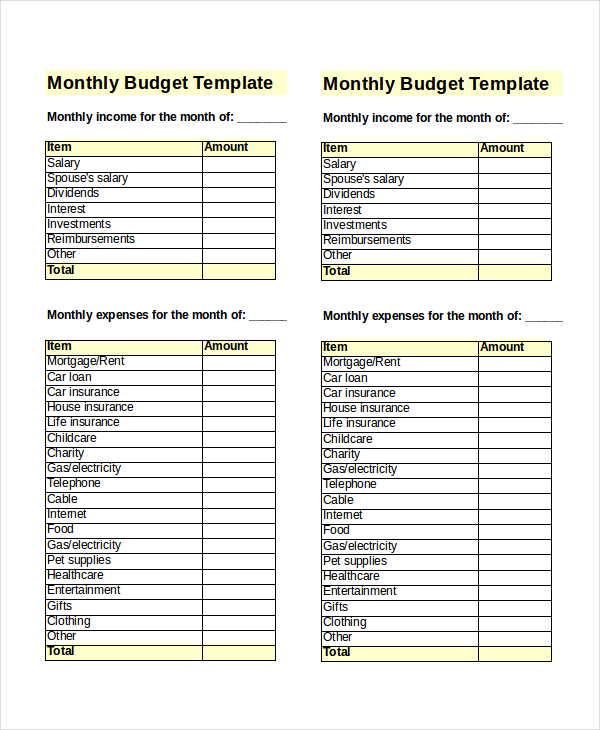

Your budget plan is going to evolve as you journey down the path of financial enlightenment. Don’t get bogged down in this as you’re getting set up the first time-guessing is just fine. Step One: How Much Do You Need?įirst, you need to come up with an estimate of how much each of those expenses will cost. Here’s an example of YNAB’s fully customizable budget template. Once you’ve listed your different category groups and the categories that fall under each one, create two additional columns: label one column “Assigned” and the other “Available.” The rest of this process will be easier to set up and maintain on a budget spreadsheet, or even easier, in YNAB. Potential expenses to include as categories when you create a budget template. It can be a budget app (ahem, YNAB), Excel spreadsheet or Google Sheets, or…a brand new notebook…whatever works best for you. Then add a category at the bottom for “Stuff I forgot to budget for” because let’s be realistic, there’s always stuff like that. Choose your budgeting tool of choice. Monthly income (use your take home pay).Don’t you wish recipe bloggers would do this? (You’re more likely to succeed in a way that sticks if you forge ahead though.) What You Need to Create a Budget Templateīefore we get started, you’re going to need to make a list of the following things: Skip all of this good advice and jump straight to a Todoist checklist to create a budget template.

So let’s talk about setting up a personal budget that will become a part of your normal life instead of another abandoned notebook. The point I’m trying to make is that the system is important, but implementing the actual habit into your day-to-day life is critical to long-term success, in both sock-matching and money management.

We can stop buying the notebooks they’re not the missing piece. Okay, at this point, I’m talking to myself about myself. Seriously-the only reason you’re not perfectly organized/physically fit/financially independent/able to find matching socks in the morning is because you didn’t have the right system! If only you had bought a new notebook, matching sticky notes, highlighters, colored pens, patterned washi tape, and fancy paperclips for that particular project, you’d be killing it by now. The hope offered by a new process, system, plan, or notebook can be slightly intoxicating-it feels like the universe might finally be handing you that one pesky piece you’ve been missing that would complete the puzzle of Responsible Adulthood. Or maybe for the third or fourth or fifth time, but you’re serious about the “for all” part on this go around.

MONTHLY EXPENSES TEMPLATE HOW TO

So, you’ve decided to sit down and figure out how to create a budget template, once and for all.

0 kommentar(er)

0 kommentar(er)